Bernie Sanders will be our next president, and he will take 70% of your income!

|

Did you watch the debates among the Democratic presidential hopefuls? I did, and I came away with two conclusions:

- Several very expensive things — healthcare, college tuition, basic universal income and existing student loans — are going to be free. Totally, totally free!

- Joe Biden is NOT going to win the Democratic nomination, and Bernie Sanders will.

Actually, I don't know who will win the nomination, but it could very well be Sanders. And if he does win, all you successful Americans can expect to pay LOT more in taxes.

A lot, lot more. And Sanders promised that all his giveaways will be fully funded with higher taxes. Namely ...

- A new 4% payroll tax on your wage income. This is in addition to the Social Security and federal withholding tax you already pay.

- A new 7% employer tax on your wages. This is in addition to the 6.2% Social Security and 1.45% Medicare tax that businesses already pay.

- A top inheritance tax rate of 77% on estates larger than $3.5 million.

- A top marginal tax rate of 70%!

Sanders isn't alone. Every one of the Democratic hopefuls has pledged to raise taxes, so you can expect your bill to substantially rise if Trump doesn't win in 2020.

Hey, vote for whomever you want …

But if you have responsibly saved for retirement and accumulated a large nest egg of 401(k) or IRA savings … AND you expect Trump to lose in 2020 … you need to seriously, seriously consider converting your 401(k) or IRA into a Roth IRA before tax rates shot higher.

401(k) and IRA contributions reduce your taxable income in the year you make them. But you have to pay tax on every dime when you withdraw those funds in retirement.

Roth IRA contributions, however, are not tax-deductible. But they are 100% tax-free when you take them out.

One of the most important retirement planning factors is your expectation for future tax rates …

|

If you expect tax rates to be substantially higher in the future, that dramatically affects the decision of when and how to withdraw money from your retirement accounts.

Thanks to the Trump tax cuts, the top tax rate today is 37%. That's a far cry below the 70% that is being talked about in Democratic circles.

What I am saying is this …

If you expect the Dems to retake the White House, you should consider converting your retirement account to a Roth IRA to take advantage of the lower Trump tax rates while you can.

When you convert a traditional IRA to a Roth IRA, you pay income taxes on your money at the time of the conversion. But this ensures you will not be taxed when you take out that money in retirement.

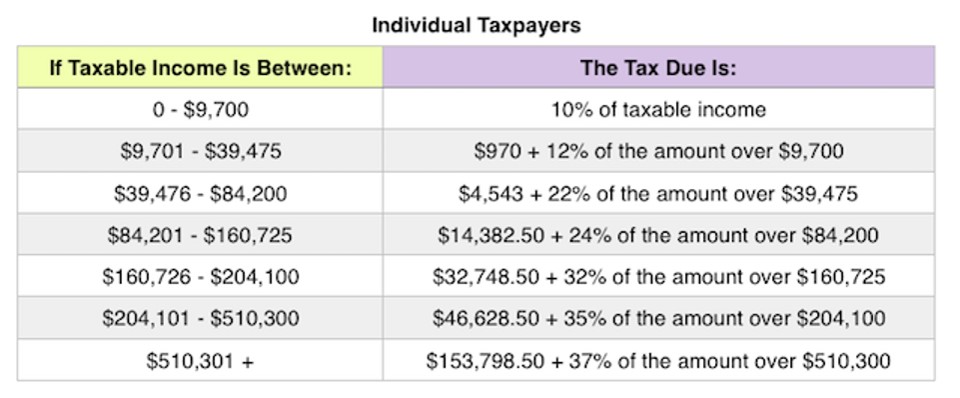

The Roth conversion is treated as a taxable distribution from your traditional IRA, so a conversion will create a larger federal income tax bill. The tax rate you pay on the conversion is the same as your federal income tax rate at the time of the conversion. (See above table.)

You can spread out that conversion tax over a couple years, which may prevent the income from the conversion from bumping you into a higher tax bracket.

The earliest that Bernie Sanders could raise your tax is probably in 2021. So, you convert 50% in 2019 and the other 50% in 2020.

Today's tax rates are probably the lowest you'll see for the rest of your life. So sit down with your tax professional and find out if a Roth conversion is right for you.

Or root for Donald Trump.

Best wishes,

Tony Sagami