Apple goes all-in on TV+, but AR is where it can really shine

|

Last week, Apple (AAPL) execs revealed a trio of new iPhones for the second year running. But it was the aggressive pricing for its streaming media service, which debuts Nov. 1 in 100 countries for $4.99 a month, that stole the show.

The pricing is un-Apple. But it is breaking the bank to get Apple TV+ right.

The Financial Times reported in August that Cupertino will spend $6 billion producing original TV shows and movies. And there is more, presumably costly, content coming from Oprah Winfrey, Steven Spielberg and Jason Momoa, the star of "Aquaman," DC Comics' summer blockbuster.

For better or worse, Apple is becoming a legitimate services company. But that's not the opportunity for investors.

Rather, it's augmented reality.

The three-camera setup on the back of its new phones will feature a laser equipped 3D camera capable of sensing depth for AR.

And this promises some very real profits.

Apple is not top of mind when most tech-savvy people think about AR. That title goes to Alphabet (GOOGL).

In Mountain View, Calif., engineers have already incorporated nifty virtual signage inside Google Maps. And the next Pixel smartphone will reportedly kick things up a notch with a TrueDepth sensor on the rear-camera module and the remnants of Project Soli, a miniature radar technology that should bring air gestures to smartphones.

It’s cool, but let’s face it. It’s Google, and probably too nerdy for the general public.

Apple, on the other hand, does mainstream extremely well.

There are rumors Apple engineers are working on augmented reality glasses. The editors at MacRumors imagine a set of stylish specs used for reading more information in museums, or to identify landmarks in the physical world.

Such a product would compete directly against Microsoft (MSFT)’s HoloLens. These mixed reality glasses are already on the market and have numerous applications like 3D modeling, simulations, virtual tourism and, of course, gaming.

In fact, the Redmond, Wash., company received a $480 million military contract to outfit U.S. soldiers with HoloLens tech in order to improve training and in-field decision-making.

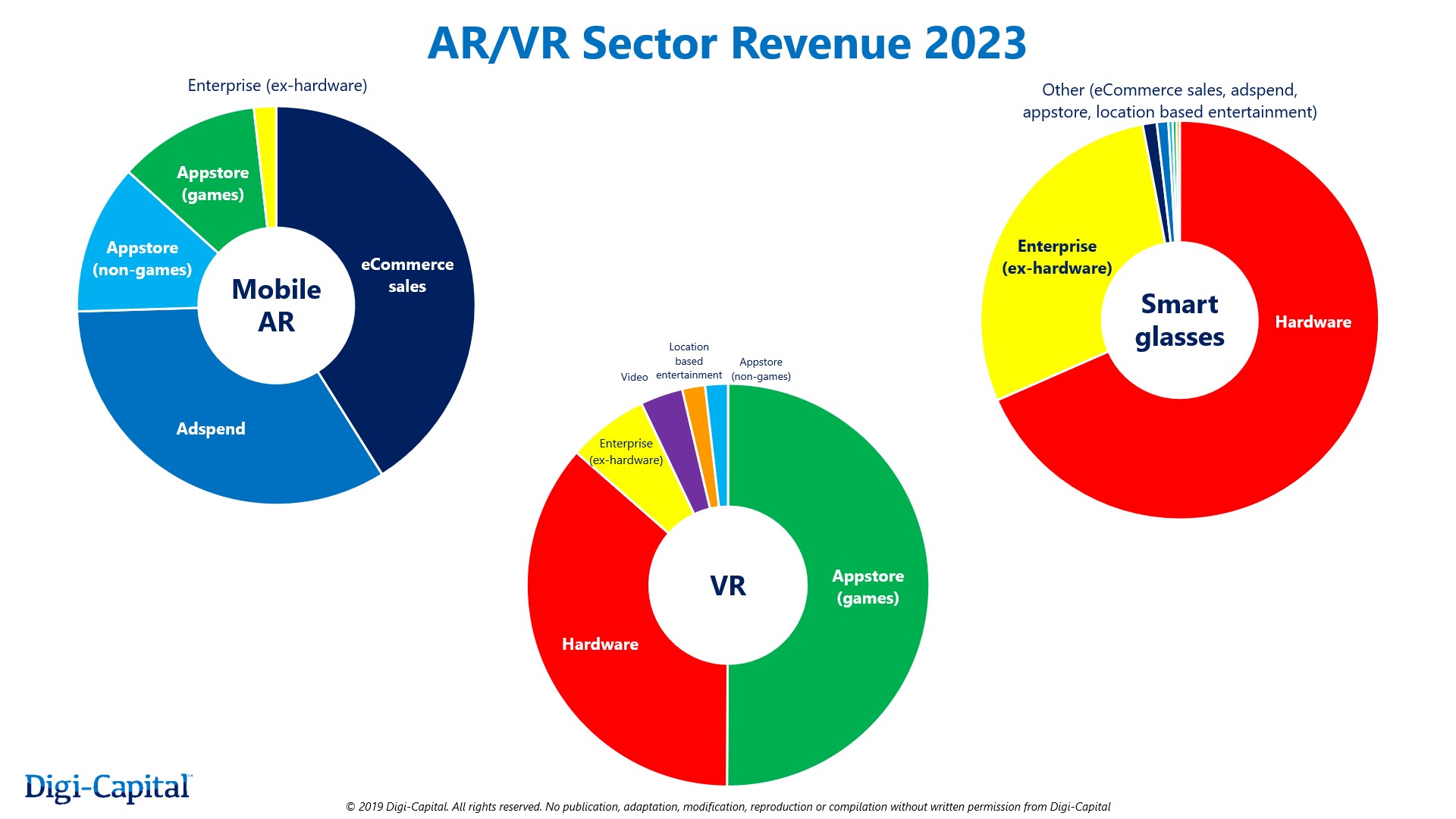

According to Digi-Capital, AR smartglasses are projected to generate between $70 billion and $75 billion by 2023.

But that’s just the device, not the bread and butter. Mobile AR appstore revenues are being dominated by games.

|

5G makes AR more immersive. Graphics are faster and more spectacular. Lower latency dramatically improves gameplay.

All contribute to higher download rates … and higher revenues.

A great example of the appeal of AR is Pokémon Go.

In summer 2016, the AR game became an international phenomenon. It used the sensors on a normal smartphone to send players into the real world to collect, train and battle virtual creatures. The title was ultimately downloaded more than 1 billion times. At its height of popularity, Pokémon Go attracted 147 million monthly active users, spinning off $3 billion in sales.

The technology was created by Niantic, a gaming business inside Google. The idea came about, according to a Google blog post, when Nintendo and Google collaborated on a April Fool’s Day Pokémon challenge inside Google Maps.

But the success of Pokémon Go isn’t the end. Niantic is progressing to the next big thing in mobile AR: 5G AR gaming.

Phil Keslin, chief technology officer, says 5G will enable a new level of gameplay that must be experienced to be believed. The technology will bring a 1,000x improvement in bandwidth and a 10x reduction in latency, or lag. To get ready, the company is planning complex new games and partnering with wireless carriers to ensure bandwidth.

Currently, games make up 25% of AR downloads on iOS — a clear majority. Gaming is also the top AR app category on Google Play, as well.

And Apple has been paying attention …

Apple CEO Tim Cook began speaking publicly about AR in 2016, following the launch of Pokémon Go. He told analysts the platform could be huge, and that Apple would make investments accordingly.

Since then, the company filed numerous patents, bought start-ups, hired new managers and launched ARKit, its AR software developer kit.

|

|

Apple shares are up 38.9% year-to-date, but down 2.1% from this time last year. |

Apple shares trade at only 16.4x forward earnings and 3.7x sales. The market capitalization is at $961 billion.

In my Tech Trend Trader service, we've stayed out of Apple since we grabbed 50%-plus gains back in November. And we've been staying out of this stock amid the shots being fired in the trade war, plus the company's general lack of innovation in recent product cycles.

However, AR could be a game-changer. And if Apple can figure out a great way to marry it to TV+ — without further breaking the bank — all the better.

In the meantime, the real opportunity right now is in 5G.

While there's a lot of hype surrounding 5G as it begins to roll out across the country, there's one BIG secret nobody knows about. And that's how to unlock 5G profits for years to come.

There’s a 93% chance you could make good money off 5G with this secret right now. Discover it here.

Best wishes,

Jon D. Markman