|

"This coat is older than you," I told my amazed 27-year-old son.

I was talking about my heavily insulated Carhart jacket that I have been wearing for more than three decades. And I think I'll get another 10 or 20 years of winter wear out of it.

The truth is that I don't spend much cash on clothes. What I do buy is high-quality and built to last. Fashion means zilch to me.

That's certainly not true of the young adults of today. According to the Bureau of Labor Statistics, the average adult aged 25-34 spends $161 per month on clothing. Women tend to spend more on clothes than men— 76% more.

No wonder the apparel industry is collectively valued at an amazing $2.4 trillion.

|

Now, I can afford to spend thousands of dollars each year on clothes. But money was hard to come by when I was growing up on a vegetable farm in western Washington state. When you don't have much, you learn to get by with what you have.

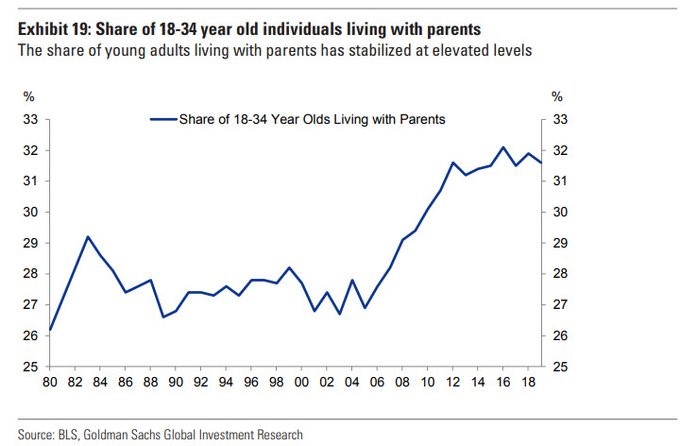

However, living within your means seems to be a foreign concept to a lot of people. In fact, I almost spit out my morning coffee when I saw how many young American adults are still living with their parents.

Almost one-third of American adults between the age of 18 to 34 live with their parents today. Wow!

Everyone's situation is unique, but my guess is that finances (or lack thereof) is the reason that many millennials live with their parents.

And with the economy doing so well and with the unemployment rate at 50-year lows, the problem isn't income.

The problem is spending.

Spending too much on clothes each month isn't the only reason for the surge in basement dwellers. I see a lot of young people driving much more expensive cars than me. Americans owe $1.4 trillion of student loan debt, and they eat at restaurants instead of cooking their own meals.

Over the years, I've talked to hundreds of people who say they can't afford to contribute to their 401k, but they somehow always find money to go out on Saturday night or buy another pair of expensive Nike tennis shoes.

Get this: The Center for Financial Services Innovation found that 42% of Americans aren't saving anything for retirement. Zip. Zilch. Nada.

It also estimates that only 28% of Americans are “financially healthy” and are successfully planning their financial futures. And a whopping 47% say that their annual spending is equal to or exceeds their income.

|

Look, how you spend your money is none of my business, but I think there is a strong correlation between the number of financially strapped Millennials and the growth in the popularity of socialism.

And I think that is a dangerous trend for America.

So, spend less on designer coffee drinks, eat a few more meals at home each week, drive the car you have until the wheels fall off and see if you can make a jacket last a couple decades.

And get out of your parents' basement ... please!

Best wishes,

Tony Sagami