3 Things My Vegetable Farmer Father Taught Me About Investing

|

As the son of a western Washington vegetable farmer, I have always been acutely aware of the seasons.

The first day of spring brought a lot more than pretty flowers and green grass on our farm. Springtime meant extra chores and weekends full of long working hours. One of my earliest spring memories was picking rocks out of the fringes of the farm. I spent hundreds, maybe thousands, of hours on my hands and knees, picking up those stupid rocks.

As I grew older, I started to help with de-winterizing farm implements, spreading fertilizer, tilling the soil and, of course, plantings.

Another event I could count on almost like clockwork was seeing my father in a suit.

My father was fiercely religious, but he only went to church twice a year: Christmas and Easter. It wasn't that he lacked faith; there was just too much farm work that needed to be done to feed his family of five.

My father wore dungarees and threadbare flannel shirts 363 out of the 365 days of the year, but he proudly wore his only suit when he went to church. My siblings and I hardly recognized him in that suit, but we knew this meant it was an important occasion.

Taking the Church Suit Out of the Closet

I distinctly remember one spring when I was 8 or 9 years old. I saw my father in his suit, but it wasn't Easter and it definitely wasn't Christmas.

"Why are you dressed up, Daddy?" I asked.

He said he was going to the bank.

The bank?

Every spring, my father would shave, dab some Vitalis in his hair, put on his church suit and go to our local bank to ask for a loan. With it, he would buy seed, fertilizer and fuel.

|

My father struggled with the low wholesale prices, the rising cost of seed/fuel, and the negative cash flow between spring planting and summer harvests. But if the weather and crop prices cooperated, he would return proudly in the fall to pay back the loan in full.

If not, he'd ask for an extension, his head hanging in shame.

Unfortunately, the bad summers seemed to outnumber the good ones, so my father never made a lot of money.

Making ends meet was always a struggle.

My classmates laughed at my hand-me-down clothes and logger boots with holes in the soles. Yet I never went to bed hungry, and my mother kissed me goodnight every night until I left for college.

Farm work was hard and I hated it — I mean really hated it — at the time, but I believe those years on the farm taught me valuable lessons about investing.

Lesson #1: Summer Profits Come from Winter Efforts

My non-farmer friends assumed farmers took it easy during the winter. Wrong! Even when snow covered the ground, my father still worked at least 12 hours a day. There may not have been any crops to harvest in winter, but there was always plenty of off-season work to do on the farm, such as repairing the machinery and mending fences.

My high school coach used to scream at us that our winter basketball games were actually won in the summer during our off-season workouts.

The same is true of investing. You make your profits before you buy a stock; not after you sell it.

Just like the rock-picking in the spring when I was a toddler, which seemed boring and meaningless at the time. But those efforts paid off, sooner rather than later.

In other words, every successful business needs a strong foundation, and the basic building block of preparing the soil is crucial.

Lesson #2: Core and Explore

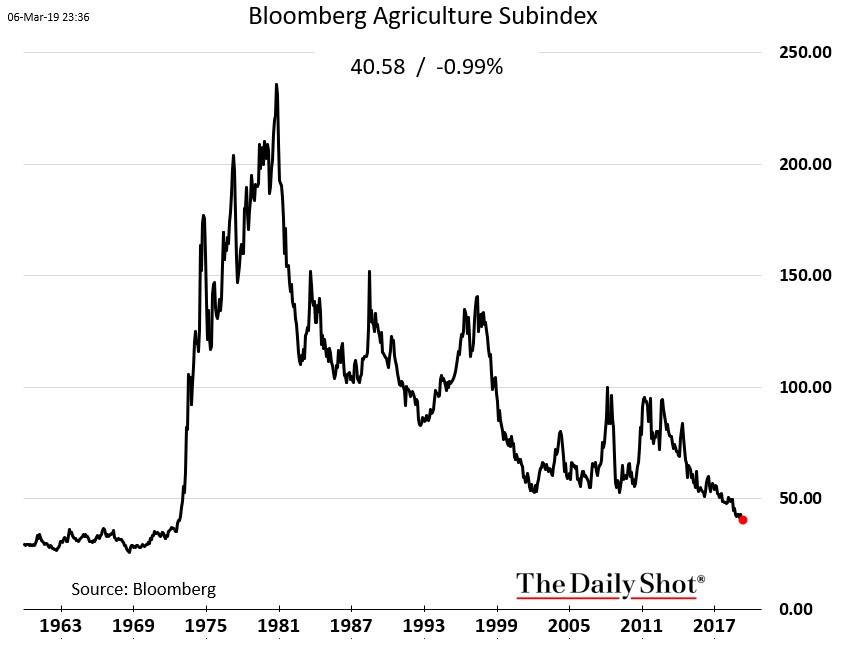

The most important decision any farmer makes is what to plant. The price of vegetables could vary widely from year to year, and many farmers would play a "Green Acres" version of roulette by trying to anticipate what the "hot" vegetable of the year would be.

|

Not my father. He stuck to red radishes and green onions for roughly 80% of our farm, and gambled with the last 20% of our land on what crops he thought could deliver big payoffs.

When it comes to investing, keep the majority of your portfolio is solid, boring, established, consistently profitable blue chips. And limit how many dollars you invest in small-cap, potential home run stocks.

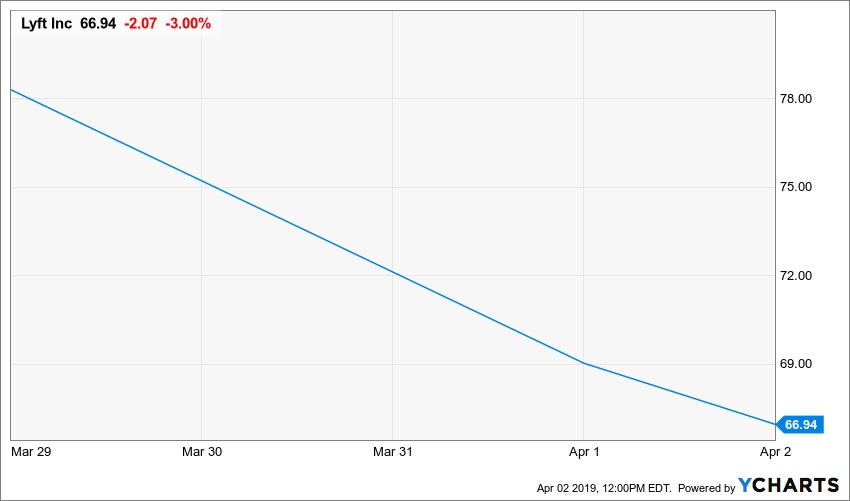

Lesson #3: Cheap is Better

What makes one farmer more successful than the other? Many of our neighboring farmers also grew radishes and onions, but what made my father more successful than others was that he knew it isn't how much you harvest, but how much profit you make on what you do grow.

My father was a very frugal man. He seldom bought anything if it wasn't on sale, so his cost was lower than most of his competitors'.

I'm a cheapskate too, so I seldom buy stocks unless they go on sale. In fact, the first thing I do every morning is take a look at the 52-week-low list.

Almost all the stocks that wind up on the 52-week-low list are there because they are horrible stocks. Sure, some of them will deliver gigantic profits. And if you have a crystal ball to tell you which ones, along with the money and patience to invest in them, you can do that. Or you can bet on strong stocks that are going up, to keep going up.

I like those odds a lot better. I think Daddy would agree.

|

***

I am sad to say my father died 10 years ago at the ripe old age of 93.

He wasn't rich, but he lived a long, healthy, admirable life and saw all three of his children become successful professionals. My younger brother is one of the top executives at Nordstrom, and my baby sister is one of the most respected occupational therapists in Washington state.

And me? My career was a mystery to my father, who always said my hands were as smooth as a woman's.

But he was madly proud of his three children, and the three of us will forever thank him for working us like dogs on the family farm. That hard work made us who we are today. And though he never owned a share of stock in his life, he's the reason why I had a strong foundation upon which to build a good life and share what he taught me with my four kids and, now, with you.

Best wishes,

Tony Sagami

|