3 Companies Proving Essential that Might Just Belong in Your Portfolio

This isn’t a new concept. In fact, it’s something that I’m sure you’ve heard over and over, especially in 2020: Many companies found their previous work model unsustainable during economic instability.

Those that adapted are still around … and share prices have recovered. Those that didn’t … well … hopefully you didn’t lose too much money there.

I’ve talked about the expansion of Dollar General Corp. (NYSE: DG) during this time. And we’ve looked at the success of companies such as Walmart Inc. (NYSE: WMT) and Costco Wholesale Corp. (Nasdaq: COST). Today, though, I wanted to check in with another staple, but less sexy, part of the economy.

I’m talking about the commercial & professional services industry.

Commercial services are things such as printing services, data processing and waste management. Professional services could be human resources support or research and consulting services. These companies tend to have a low volatility because no matter what happens, demand for these services tend to remain very stable.

Even during a shutdown, many processing and consulting companies moved to an online model with the help of video conferencing software. And nobody was arguing whether waste management was essential or not.

So, I opened the Weiss Ratings stock screener and found that there are 18 companies in that industry with a current “Buy” rating.

Let’s take a look at the top three.

First up, we have the global leader in online vehicle auctions. Copart, Inc (Nasdaq: CPRT) has a 100% online platform of auto auctions featuring used, wholesale and salvage vehicles for sale. As of this writing, Copart has 195,938 vehicles for sale.

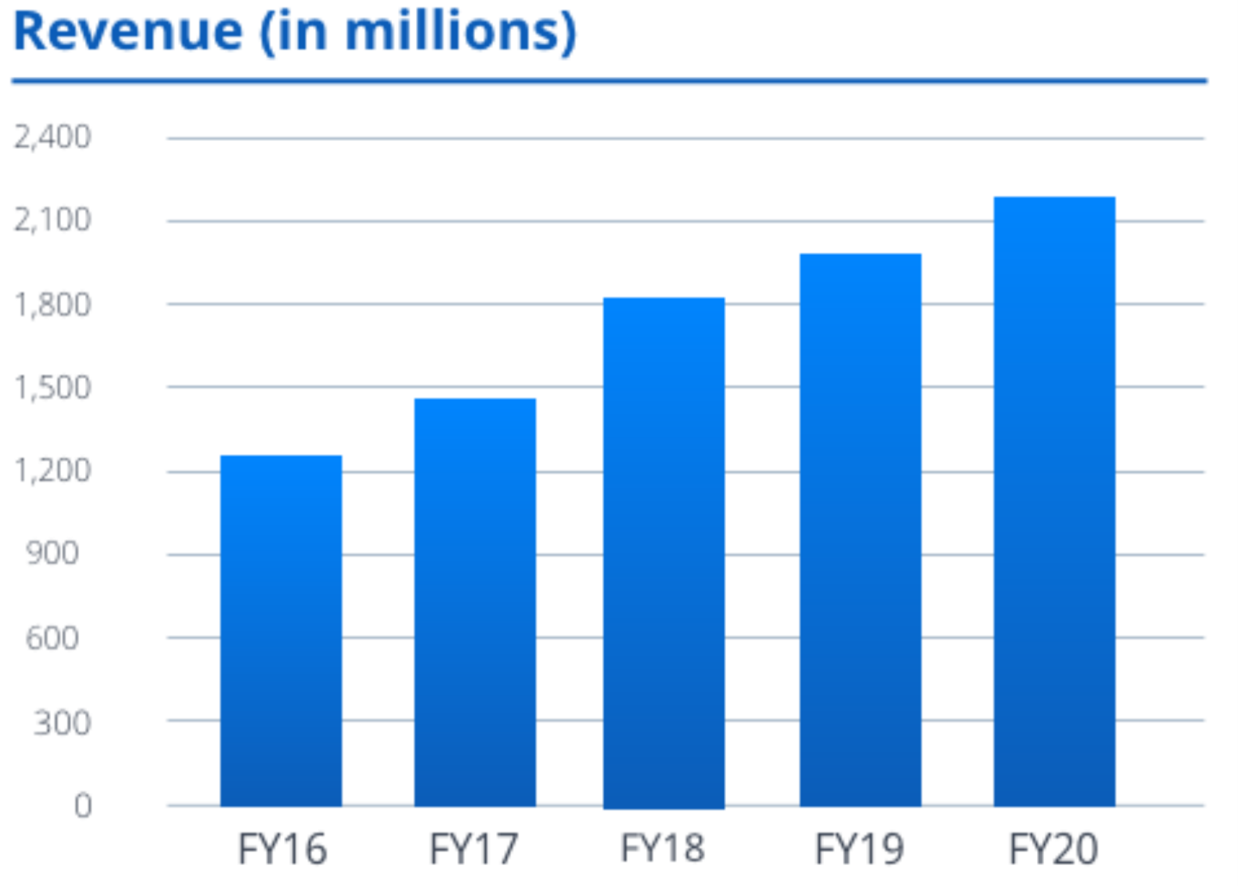

The company has something for dismantlers, body shops, salvage buyers and even individual consumers. Used vehicles are still moving and Copart saw revenues still increase in 2020 compared to the previous year.

|

Next, we have Republic Services, Inc (NYSE: RSG). There’s no argument that this company provides an essential service by providing non-hazardous solid waste collection and disposal. The company has over 340 collection operations, 212 transfer stations, 189 active landfills and 79 recycling processing centers. Plus, the company has 15 saltwater disposal wells.

With a business like that, of course Republic Services continued to see solid free cash flow generation. Their seasoned management team, which has been through previous cyclical downturns, ensured the company was able to re-allocate resources, acquire PPE and avoid disruption of service.

Last, but not least, we have Ritchie Bros Auctioneers Inc. (NYSE: RBA), which is another online auction site. Unlike Copart, Ritchie Bros specializes in used industrial equipment and other durable assets. And they also offer equipment financing and leasing through Ritchie Bros Financial Services.

Earlier this week, the company issued a press release stating that the latest used equipment market trend shows price inflation in all equipment categories, including as high as 8% in the truck tractors category. This trend makes sense with everything that we know about 2020.

Companies everywhere are trying to figure out how to save. So why not buy equipment used instead of new?

These are three great examples of companies that have the ability to make small changes and continue to stay resilient. Plus, as I pointed out earlier, being in an essential industry doesn’t hurt.

As an investor, keep an eye out for companies that have stood strong against previous economic downturns. It’s usually a good indicator if they’ll hold strong in the future … or if they’ll drag your portfolio down.

Best,

Kelly