|

| By Sean Brodrick |

Man, have small-caps been a big disappointment so far this year. And it wasn’t supposed to be this way.

At the end of 2023, small caps outperformed the market and especially Big Tech rather sharply. So, Wall Street assumed 2024 was supposed to be small caps’ big year. But that’s not how it’s worked out.

Small caps are down for the year, while tech is up 2.3% and the S&P 500 is up 6%. Some parts of the small-cap universe are doing even worse!

Small-cap tech recently hit new five-month lows, down more than 13% from its December highs. So, we should avoid small caps going forward, right?

Nope!

What if I told you there are small-cap stocks that are eating the S&P 500’s lunch? And you can buy them right now?

Define The Problem, Find the Solution

What’s hammering small-caps broadly is that the Fed has kept its benchmark interest rate higher for longer than Wall Street thought possible.

Small-cap stocks generally need to borrow money at some point — small-cap tech even more so — which means they are borrowing at higher and higher interest rates. That just hammers earnings potential.

On the other hand, what about small-cap stocks with plenty of cash flow? They don’t need to borrow at higher rates. Those are the ones that can really outperform — not only their index and the S&P 500 but the expectations that brain-dead Wall Street is working from.

I can think of two small-cap investments that can do very well indeed. And you can buy them now at bargain prices.

Investment No. 1: CALF

The Pacer US Small Cap Cash Cows 100 ETF (CALF) has a Weiss rating of “C+,” and it focuses on stocks with plenty of free cash flow — in other words, “cash cows.” CALF has a dividend yield of 1.06% and an expense ratio of 0.59%.

Companies with high free cash flow can survive high rates. Heck, they can thrive in this environment, because they are not burdened by the financial restraints other small-caps have.

Investment No. 2: PSCE

The Invesco S&P SmallCap Energy ETF (PSCE) has a Weiss rating of “C+.” It holds small- and mid-cap energy oil and gas stocks. This ETF has a total expense ratio of 0.29% and a dividend yield of 2.11%.

Oil is up 14.3% so far this year. While it has backed off highs hit earlier this month as tensions in the Middle East have eased, there’s still plenty of bullishness to drive oil prices higher.

The bullishness is due to Ukraine’s ongoing drone bombing of Russia’s oil infrastructure, the extended OPEC+ supply cuts and increased global demand.

I expect oil to range between $75 and $95 this year. And that will translate to PLENTY of cash flow for oil companies large and small.

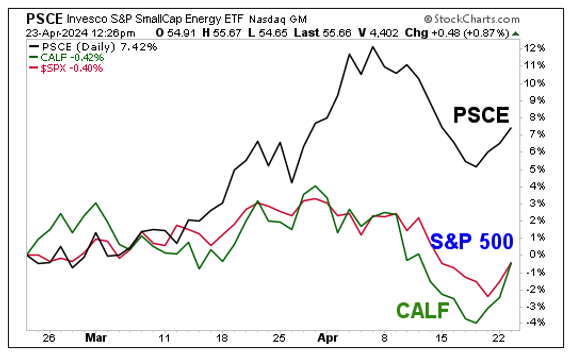

Let’s look at a chart comparing the performance of CALF and PSCE to the S&P 500 over the past couple of months, as Wall Street has wrestled with the idea of “higher for longer” interest rates.

You can see that PSCE — the basket of small-cap energy stocks — is the real outperformer here. However, CALF is starting to catch up with the S&P 500 and just nosed past it. I believe there is more outperformance ahead for both funds.

In fact, I like PSCE and CALF so much that I may add them to my personal portfolio. By buying them today, you can get in ahead of me.

The great thing about investing in small caps is that Wall Street doesn’t put these smaller companies under the microscope the way it does large-cap stocks. So, there can be plenty of surprises. And with research and a little luck, those surprises can boost your returns enormously.

You can also drill down into these funds and find the best individual stocks. They carry higher risk, but also the potential for much higher returns.

If you want, stick with the S&P 500. But I’ll bet on the little guys. They could deliver a big surprise this year.

That’s all for today. I’ll be back with more soon.

All the best,

Sean

P.S. Here’s one more thing I’ll bet on: the cryptocurrency sector. In fact, in the cryptocurrency world, the smaller tokens and cryptos have already been able to make 205 times as much in investor returns than Bitcoin.

Take a look here while you can. This special presentation is scheduled to be taken down later today.