Buy the Modern Version of Netflix’s 15,050% Profit Switch

Editor’s note: Your tech guru, Jon Markman, recently shared the following with his Disruptors & Dominators readers. But he insisted on sharing it with you, as well. The takeaway is worth it …

|

| By Jon Markman |

Something really big is happening in the technology sector.

The shares of businesses that run the biggest digital platforms in the world have rallied significantly since the 2023 lows.

Investors are awakening to digital transformation. This is the idea that processes in the real world are being transformed into bits of data that can be moved around quickly, stored and analyzed to glean insights.

It’s easiest to think about digital transformation in terms of Netflix (NFLX).

Executives at the streaming media giant disrupted media content delivery by digitizing DVDs. Watching a movie became as easy as pressing a button on your TV, game console and, later, smartphone.

In that instant, nearly every DVD rental business in the country became obsolete.

Netflix execs made media consumption more convenient and, ultimately, cheaper. That wasn’t the best part of the story, though. It was data analytics.

As all the processes became digital, Netflix engineers could see what titles were being viewed, what parts were being replayed and where members switched out for another title.

Executives at the company used this data to build a highly addictive content catalog. And that is when the network effects took over.

The value of Netflix was increased by the number of subscribers using the service. We naturally want to watch what our friends are watching. We were hooked.

So-called “professional traders” have hated Netflix since its streaming debut in 2009 because their investment models said shares were too richly priced.

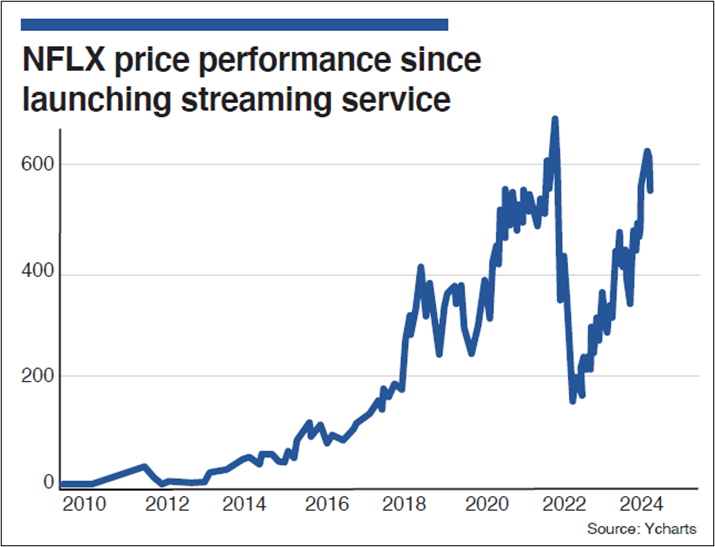

Netflix shares are ahead 15,050% since then, versus a gain of 294% for the S&P 500. On average, pros have performed even worse, but put a pin in that.

The Netflix digital transformation story is cool. Although, what is happening now makes that evolution seem puny.

Today’s Version of the Netflix Switch

The largest digital platforms are building out the next stage of the transformation. Data centers are being refitted with artificial intelligence clusters, and all the corporate world is about to have a Netflix-like moment.

Companies are going to use real-time data to inform business decisions, interact with customers via generative AI chatbots that will be indistinguishable from humans and other game-changing applications.

All of this is happening right now in plain sight. The changes will create generational wealth for shareholders.

Admittedly, “professional traders” are on the other side of these trades. This is not because they don’t understand what is happening. They get it. They can see it.

The financial services sector is ground zero for many digital transformation strategies, partly because all of those investment pros make so much money. Their bosses are looking for ways to replace them with software. Yet, that’s another story.

The problem for pros is their models say shares of tech businesses driving these changes are too expensive.

The Price Apparently Isn’t Right

You will hear a lot of pros drone on about path being more important than prediction, or that the best portfolios constantly reduce exposure to factors that are most volatile.

The pros-speak is that regression analysis shows that most investments ultimately revert to their longer-term, mean growth rates. Therefore, the models routinely call for swapping out assets that are deemed expensive for those that are modeled to be cheap.

This seems like common sense. After all, we are conditioned to believe “buy low, sell high” is a time-tested investment paradigm.

Unfortunately, real-world statistics show that this is absolutely terrible investment advice for longer-term investors. It is a strategy for endlessly downgrading portfolios with shares of crummy businesses, the losers.

Chi Chi Rodrigues, the legendary 1970s PGA golfer, often recounted growing up on what he called the wrong side of the tracks. He attributed his success in life to a simple philosophy of hard work and a winning mentality. To get there he surrounded himself with positivity and people with winning attitudes. You “hang around with losers, you become a loser” Rodrigues used to preach.

The investment models used by pros encourage rotation to shares of businesses that are real losers. This means, by design, portfolios hold too little stock in companies that are disruptive. These are the businesses most likely to dominate emergent sectors and reward shareholders with incredible wealth.

They are also the stocks that account for about 97% of the gains of the S&P 500, according to an exhaustive study by Hendrik Bessembinder, a finance professor at Arizona State University.

Unsurprisingly, a 2023 report from S&P Global found that 94% of professional money managers routinely failed to beat this benchmark.

But do you know what does beat the S&P 500 benchmark? Artificial intelligence — the very digital transformation that money managers are selling in their own portfolios.

In fact, Dr. Martin Weiss just unveiled a first-ever marriage between truly unbiased ratings and AI.

And guess how it has performed over the past 10 years? It beat the S&P 500 by 51-to-1.

That’s right. While 94% of professional traders can’t even beat this benchmark, this new AI trading system not only beat the S&P … it smoked it with 51x returns.

I urge you to check out exactly how in this remarkable interview …

All the best,

Jon D. Markman